Context

The first quarter of 2025 will remain as an empty passage for the whole crypto market. Between the persistent macroeconomic tension, the caution of investors and the demand in half the mast, most of the projects have seen their courses in the collapse of their courses and some of them flirted with their lowest level 2023.

Regulatory context: Locomotive of altcoins season

PUSH Altcoin season Not only launched on technical trends or community fomo. This time it is a control framework that could play the role of the main catalyst. According to the latest report, the Swiss crypto bank SYGNUM has been radically attacked since the beginning of the year, especially in the United States, where several stablecoin and tokenization accounts have exceeded the key phases.

This turnover control point is necessary: finally offers a credible institutional base, while opening doors to structured altcoins such as ETF, possibilities or future that should arrive in bulk by the end of 2025.

But that’s not all. The boom in tokenization -y oriented blockchains, such as the Ondo or Plme Network, indicates a clear shift to the more serious acceptance of altcoins. This new generation layer 1 seeks only to make noise, but also to make real flows from traditional financial markets.

With the open support of Larry Fink (Blackrock) for rapid tokenization of stocks and liabilities, altcoins in the heart are much more macro narration than before. The Altcoins season can therefore rely on structural demand this time, much stronger than the season that has been observed during the previous bulls.

Eventually, the altcoin ecosystem becomes ultra-competent but in the right direction. So we are no longer just talking about the same or passenger residential, but about the real battle of economic value. Projects such as Toncoin or Berachain experiment with new models of income sharing, administration of public affairs or developers incentive.

In addition, this dynamics arrive directly when Bitcoin reached the peak of dominance he had never seen four years. Result? Market imbalance ready for repair. And if this correction finally sounded a real beginning of the beginning Altcoin season ?

What does graphic analysis tell us?

Technical analysis is clearly He is not a bull yet In the Altcoins season. The CoinMarketcap indicator shows the shy 16/100barely over his lower 13 In December 2024. On the side of the Blockchain Center, the same atmosphere: the index of the altcoins limited to 18. Bitget? The same bell sound with a score 17. In short, we are still in the middle of the winter altcoin, far from the euphoria real Altcoin season.

Altcoin Index – Source: CoinMarketcap

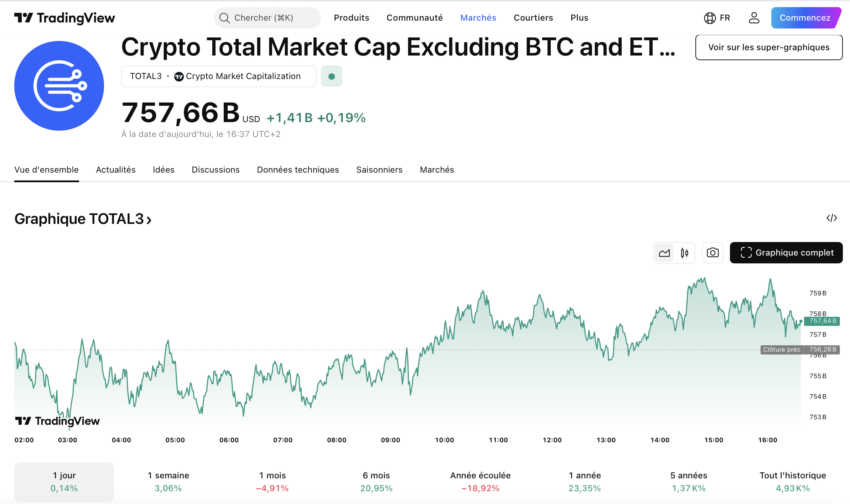

The most watched representatives confirm this trend. A total of 2 (capital without BTC) dropped by 27 % since the beginning of the year and 7.53 % in the last month. Just rest: a small weekly reflection of +3.63 %to be taken with tweezers. A total of 3 (except BTC & ETH) is slightly better: -4.91 % in 30 days, despite +3.06 % in 7 days.

It is not enough to scream in the altcoin season, but maybe the beginnings of the conversion.

Total 3 Lessons – Source: TradingView

And the dominance of Bitcoin in all this? It’s hit: 63.83 %, by 3.88 % per month, literally crushes altcoins breathing. As long as the “King of BTC” retains so much attention and flow, the altcoins season remains in the night light. To really take off, it will take a brutal change in the market psychology … and it can happen faster than you think.

Morality of History: Altcoin Season is Santa Claus merchants. The more we believe, the more we risk buying a top.

Notification of irresponsibility

Notice of non -response: In accordance with the TRUST project, Beincrypto undertakes to provide impartial and transparent information. The aim of this article is to provide accurate and relevant information. However, we invite readers to verify their own facts and consult a professional before it decides on the basis of this content.