What to track with constellation energy (CEG) before investing Motley fool

Contellation Energy sells electricity, but the big story is how it does electricity.

Constellation energy (Ceg -1.93%) It sells unregulated electricity directly to consumers and businesses, which makes it competitive. This is very different from the regulated usefulness that should be used in areas that a monopoly has a monopoly.

There is a good and bad thing about focusing on the competitive power of Contellation Energy; Here are three things you have to watch if you are considering buying it today.

1.

Regulated usefulness are Grantd monopolies in areas that serve, but must accept their rats and plans of capital expenditure dictated by the government. Regulatory bodies seek to find a balance between investors’ return, severity of supplies and customer costs. The final result is usually slow and consists of growth for regulated services in good economic and bad. Constellation Energy is more of a hit-or-message type.

Image source: Getty Images.

Although the company tends to sign long -term contracts with customers, it is increasingly connected to market rats for energy. Therefore, good times can result in attractive trends in income and earnings. However, the bad time can lead to difficulties on the upper and lower line. In addition, without government regulation, any investment constellation energy comes with a much greater risk if they terminate the work as planned.

Before investing in constellation energy, make sure you fully understand the varabibility that is for the sale of electricity outside the more traditional control framework in which it works.

2. Nuclear energy constellation is now hot

The constellation focused on nuclear energy that does not produce greenhouse gaunes; It generates strength and high level (it makes it a strong source of base of the base) and once built, there is a relatively low -cost energy option. Since many sources of pure energy, such as solar and windy, are intermittent, nuclear energy now has something Renaissance. Not only is not only 90% of the energy without the energy of the constellation, but this force is distorted to the nuclear force.

This is a double victory for the constellation. Nuclear energy can essentially help to smooth outstands and falls in the supply of solar energy and wind. Now, chatting, it can be used to supply clean energy for energy instant, such as data centers and artificial intelligence (AI). With the demand for data centers, the systematic energy is already inking large nuclear energy with technical giants as Meta platform. This is good news, but investors will want to carefully monitor the data center and AI spaces if they buy the constellation energy.

3. The valuation of the constellation may be a problem

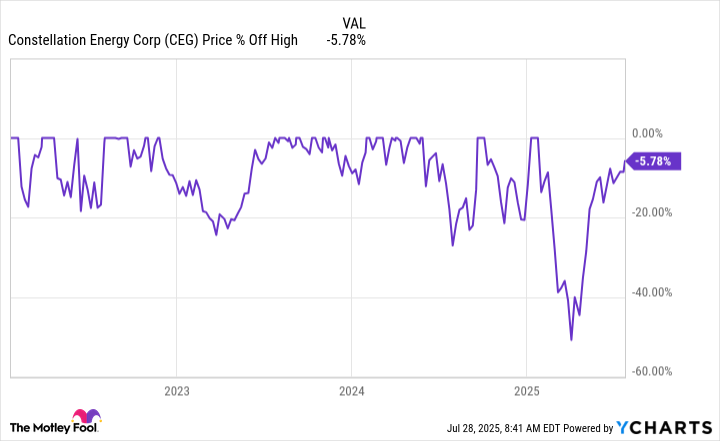

Even great businesses can turn into a bad investment if you pay too much for them. Right now, Contellation Energy’s dividend yield is 0.5%. In 2024, the yield was twice the level of this level. The average service material has a dividend yield of approximately 2.8%. Looking at the appreciation of Contellation Energy in a different way, the ratio of earnings is more than 30 times. This would be high for a fast -growing technology company, let alone a company that produces and sells electricity.

CEG Data from Acharts

But here’s an interesting thing. In 2025, the shares withdrew 50% earlier. And 25% of drawing is quite common, historically. If you are looking at the constellation’s energy now, it seems a little expensive. As already mentioned, when buying supplies, it depends on the valuation. But if you follow the price and award, history suggests that you will eventually find a better entrance point.

The constellation’s energy is probably the observer

The Contellation Energy has an interesting business model that seems very well located right now, especially on the front of the nuclear energy. Although these are important facts, it is also prices that investors pay for stocks. For most investors watching the awards, this is likely to be the best consent. Another move could be that you can buy in an attractive long -term power story. But you may have Adaiser to get out of this occasion, which you prepare to buy in advance.

Reuben Gregg Brewer has no position in any of these shares. Motley Beble has positions and recommends constellation energy and meta platform. Motley fool has a publication of politics.