Miles ‘Burt’ Marshall, 73 -year -old Poststate New Yorker, defendant from the alleged Ponzi scheme of $ 95 million

For decades, Miles “Burt” Marshall has been a man you want to see in the Upstate New York section if you had some money to invest, but you wanted to keep them located.

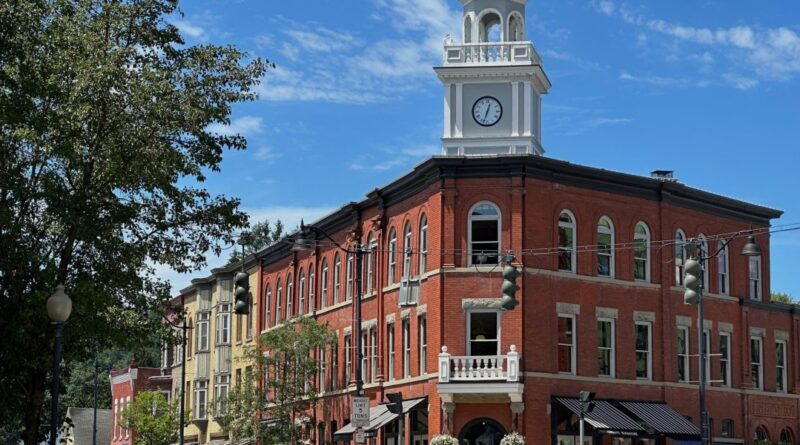

Marshall worked from an office in the charming village of Hamilton, on a road from Colgate University, prepared taxes and sold insurance. He also took the money for what Somits was called “8% Fund”, Wh has guaranteed so much annual interest no matter what happened to the financial markets.

His customers spread the word to family and friends. Do you have pension eggs? Let Burt handle it. It invests in local rental properties and your money will grow faster than in the bank.

Marshall was friendly and folk. He gave gift bags with maple syrup, cucumbers and local honey in glasses marked with cute statements, such as:

“Hewld tells you about all other people who invest. Churches invest. Firefighting companies invest. Doctors invest,” said one client Christine Corrigan. “So you would think:

Then it all collapses.

Marshall owed nearly 1,000 people and organizations about $ 95 million to the main and interest when he asked two years ago to protect against bankruptcy, according to the administrator.

This summer, a 73 -year -old entrepreneur was on the basis of fees that his investment activity was Ponzi Sccheme. If he is convicted, he could face a prison.

Marshall’s lawyers refused to comment.

The total losses of investors Marshall do not reach the multiblion dollar Ponzi scheme, which dominated Bernie Madoff. But in a small university city, about 6,400 people and its mostly rural surrounding areas are being built.

Many investors were professors Colgate, workers, office workers or downloaded. Some have lost their life savings tens or hanging thousands of dollars. Corrigan and her husband, who own the restaurant 30 miles (48 kilometers) east, had about $ 1.5 million owed.

Now he is wondering what someone who looked so reliable, who organized annual parties for his customers and even called them for his birthday, could betray their trust.

“You look at life differently after it happens. It’s like,” Who do you trust? “Dennis Sullivan, whom he owed about $ 40,000, said.” It is sad that what he has done in this area. ”

Local entrepreneur reliable

Marshall and his wife lived in the Victorian bricks, blocking from his office. In addition to preparation for insurance and taxes, he rented more than 100 properties and operated a self -service and a press trade.

His parents in this area operated an insurance and real estate trade and Marshall name was respected locally.

Although he leaves university, he was a federally registered tax professional. For many in this area he looked good informed about money and maintained a neat office.

“He had a French door and a beautiful carpet and a large table and looked like he was prosperous and reliable,” Corrigan said.

Marshall began to take money from people to buy and maintain real estate at the age of 80. People got promised notes back – slipping paper with a dollar writing. People could decide to get regular interest payments.

Participants saw transactions as an investment. Marshall called them loans.

For many years, Marshall has corrected the promise to pay interest and processes. More people participated in the spread of words. Sullivan remembers how his parents gave Marshall’s money, then did it, then his fiancé, then his daughter of his fiance, then his son and even his snowmobile club.

“Everyone gets into the snowball,” Sullivan said.

Many investors lived in other countries, but had a connection with the area.

The promise of 8% of yields was not negligible in the 80s, at a time of higher interest rates. But it appeared that the rats dropped. Marshall told the bankruptcy of the advancing that he assumed that his real estate approval would be more than covered by debts.

“Of course, that’s false now,” he said by submission, “but that’s what I always thought.”

Count on debt over $ 90 million

By 2023 the money stopped flowing.

In April, Marshall asked for protection against bankruptcy in Chapter 11 and declared more than $ 90 million liababilits and $ 21.5 million on assets, most of them in the real estate area.

He explains that he has been hospitalized for the “serious heart condition” that required two surgery, which cost him $ 600,000. When the news of his illness expanded, there was a run that the holders who noticed were asking for their money back.

The bankruptcy manager, Fred Stevens, accused Marshall’s accident on incompetent business practices and loans from people at higher market rates. The administrator satisfied that by 2011 Marshall used new investment money to pay previous investors, a characteristic feature of Ponzi Sccheme.

The prosecutors claim that Marshall falsely represents the profitability of his real estate business and has his employees generate “summary of transactions” with false information about the balances and interest gained.

The money was transferred to their next business and spent thousands of dollars of investors for Persons, including traveling by airlines, meals, food and yoga studies, ruins.

Marshall customers feel betrayed.

“We left it there to accumulate. Well, it accumulated in your pocket,” Barbara Baltusnik said about her investment.

Undulating effects of loss worth several million dollars

In June, Marshall confessed to accusations of large fraud and fraud with securities. He is charged with more than $ 50 million.

Marshall’s home and real estate were sold in the bankruptcy proceedings that continue. People who gave Marshall their money a stand to reduce by 5.4 cents per dollar from the sale of assets. According to the administrator, potential claims against financial institutions are carried out.

Baltusnik said that she and her husband got hundreds of thousands of dollars and now wonders how she pays medical accounts. Sullivan’s mother moved with him after she lost her investment.

In Georgia, Epworth, Download Carolyn Call, he will never see the money hoping to help increase her social security payments. She found out about Marshall, although the uncle who lived in the UPState New York.

“I’m just paying my accounts and continuing,” she said. “Nothing extravagant. No trips. I can’t do anything for grandchildren.”

(Tagstotranslate) New York (T) Ponzi Scheme