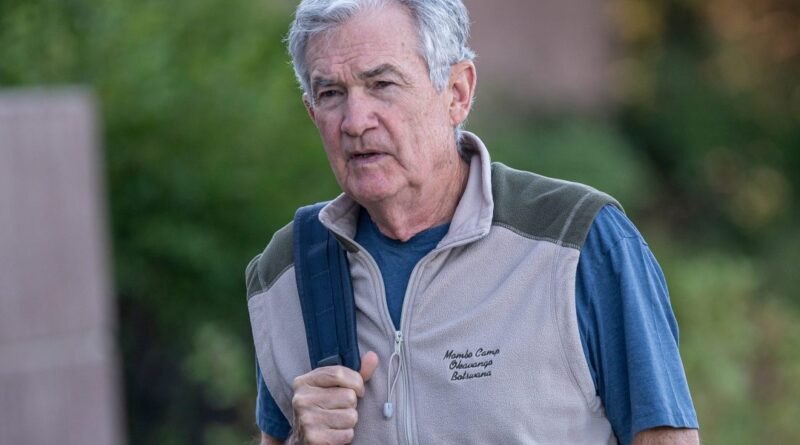

Fed Jerome Powell’s chair can really disappoint Wall Street in Jackson Hole

On Friday, all eyes turn to the chairman of the Federal reserve system Jerome Powell when Scheuduled shows a highly anticipated speech at the Central Bank conference in Jackson Hole, Wyo.

Previously, the annual events served as an opportunity for politicians to tease the format movements. Last year, Powell reported a pivot on cuts and said, “It is time to adapt to politics” and that “my trust grew, that inflation is on a sustainable trip to 2%.”

Wall Street is greatly expected to restore the Fed Reduction in September, after it has been discarded for several months when President Donald Trump’s tariffs are moisturizing by economy. This is like Trump and the White House exerted immense pressure on the Fed to ease, while the governor was the council of the governors.

However, Powell does not have to reduce great advice this year.

First, some analysts think that in September there is a reduction in the bag in the bag, because inflation removes 2% Fed’s target and checks high because tariffs place pressures on prices.

Meanwhile, the economist discusses where the deteriorating job data is caused by the weak demand for workers or a weak offer. If there is a supply problem, the decrease in the value would worsen inflation.

“The tariffs are unastently living in the coming months and wrote Michael Pearce, a representative of the chief US economist in Oxford Economics.

Meanwhile, he thinks the Fed will remain suspended until December, but the weak August Jobs report will change his opinion.

The market veteran Ed Yardeni has maintained the prognosis for this year “Ne-Abone” and said the Fed would stop on cuts due to the ever improved inflation and continuing resistance of the US economy.

As for the Jackson Hole, a note from Yardeni’s research on Sunday predicted that Powell would keep his cards close to his vest.

“It is likely that the owl will be more – waiting and watching – Tihan Eith Jawa or back,” he said. “In other words, he says that at the September meeting it is possible to reduce feed rates, but the Fed’s decision is dependent on data.”

This year, Bank of America was similarly skeptical to reduce rates and pointed out that Powell suggested in July that he would be comfortable with low employment because the unemployment rate remains in close ranges.

This scenario now looks like it is becoming a reality, and Bofa said that Powell’s speech Jackson Hole would give him a chance to “go through”.

“If Powell wants to lean on September, he could say that the position of politics remains reasonable about the data. We will notice that this phrasing weld it to maintain the possibility of cutting if the augulation report is very weak,” the bank said in the note. “From the race, he could also telegraph cut by switching to a less restrictive political attitude.”

Wall Street is such a thorough price in September that signed investors may have to live together, not just a serious decline – he would feel like an increase in rates.

Preston Caldwell, the chief US economist in Morningstar, wrote on Tuesday that given how long the market has been expecting a reduction, “it is postponed much further, which would be an effective tightening of the monetary police on this internship.”

“We don’t think Powell can firmly lead to ease”

But even some economists who think the Fed will decrease next month are dubious that Powell will tilt his hand on Friday.

JPMorgan said that the tension in the dual Fed mandate between combat inflation and maximizing employment is now preferred.

Despite recent inflation data indicating that tariffs are filtered into more prices, the disappointment report should lean the Fed towards cuts next month.

“However, with several Fed speakers, the Fed has recently arisen that the cut is not carried out, but with other employment data, we do not think that Powell can lead to lightness at the next meeting,” JPMorgan said on Friday.

Citi Research, American economist Andrew Holelenhorst, thinks Powell is hitting the cut, but it does not exceed.

Help could come in the form of notebooks for employment and inflation occurs in balance. In July Powell said that if they are in balance, then rats should be neutral. Given that he identified the current level of rates as “slightly restrictive”, suggesting that balanced risks would deserve a cut.

Sale then shows job data that the labor market has reinforced, which allows Powell to say that the risks are more balanced and that the reduction of rates would be appropriate next month, if this trend continues, Holenorst wrote on Friday in the note.

“We expect President Powell to confront prices on the market for a return to the rates in September, but will cease to commit explicitly to decrease at this meeting,” he said. “We do not expect to comment on the size of the cut, but it is safe to assume that the basic case is at the moment for a 25 bp cut.”

(Tagstotranslate) Fed interest rats