Alphabet 5 reasons is the smartest stock you can buy right now | Motley fool

No other large technological shares give the value that the alphabet fees.

Alphabet (Google -1.51%) (Googl -1.45%) It is one of the few large technological shares that will not bring massive premium to the market. As a result, many investors can be attractive.

But buying supplies is simply cheap, there is no intelligent idea. For good reasons, the plants are cheap for good reasons. Nevertheless, I think the alphabet is an excellent purchase at this price point and I have five reasons to support this perspective.

Image source: Getty Images.

1. Google search return is growing

The biggest reason why the shares of the alphabet with discount for its peers is that the market is worried that the bass company will collapse. Although there are several brands under his umbrella, Google search is the largest.

The theory is that Google search will not be able to compete with different generative AI services. If more people use generative AI than searching, the returned alphabet will throw it with it and drag their profits.

While several people seem to hold this opinion, and there is evidence that Google is very slowly losing some use on generative AI, it did not affect its results. In the second quarter, Search returned a pink 12%year -on -year. This is an acceleration of 10% of the growth of the previous quarter.

Obviously, Google search is doing quite well and the central argument on the Bear case is not supported by financial results.

2. Looking up a search AI bridge the gap

Just because General AI calls Google does not mean that it ignores it. Instead, it has accepted generative AI and offers an overview of AI search at the top of its results. Management says this has become a very popular function and was used by more than 2 billion people in 40 languages.

While the alphabet can see some defectors on generative AI platforms, its AI search reports could provide enough generative AI experience to maintain the vast majority of its user base.

In addition, the management said that the overviews surrounded the same monetization as regular Google search, so with this integration it does not lose your income.

3. Google Cloud is gaining strength

Another key part of the investment thesis of the alphabet is the growth of Google Cloud, its cloud computing wing, which allows its customers to support highly contaminated computer devices over the Internet and perform workload. The Google Cloud has recently gained strength and even captured one of the most important customers in the world: OpenAi, Chatgpt, one of the leading generative AI models.

Although Google has a competitive model, Gemini, it remains neutral on the cloud computing market and allows you to use other models. This neutrality has been attractive to OpenI and believes Google enough to start its workload on its servers. This is a huge customer victory for Google Cloud and presents its overall strength

4. Google Cloud’s finance improves

Google Cloud had an excellent first quarter and increases 32%year -on -year. In addition, the operating margin of the segment is improving rapidly, with 21% margin in the second quarter, as compared to the year by 11%.

Since Google Cloud is still growing fast than the rest of the company and the operational margins are improving, this segment will become a much greater part of the alphabet’s investment work. Cloud Computing has powerful tail winds, involving traditional migration of workload and growth of workload AI.

This segment will continue to grow rapidly and will become a key part of the company’s total financing over the next decade.

5. Shares are dirt cheap

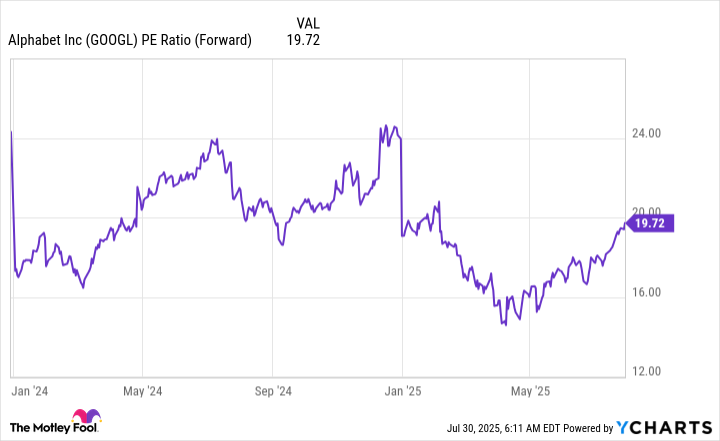

Alphabetical shares that are circling back to the top are incredible right now. Traded for less than 20 times earnings, which is significantly cheaper than the Broade market, measured S&P 500Which trades in ahead of the earnings.

Googl PE ratio (forward) from Ycchart; PE = price for earnings.

Most large technological shares are traded with a high range of 20 years of pre -centered prices (P/E) up to 30 years. This EITH causes the alphabet to underestimate or the second group overvalves. It’s been a long -term, it’s now an excellent purchase and it’s a great way to ensure that you don’t survive for a big technological event.